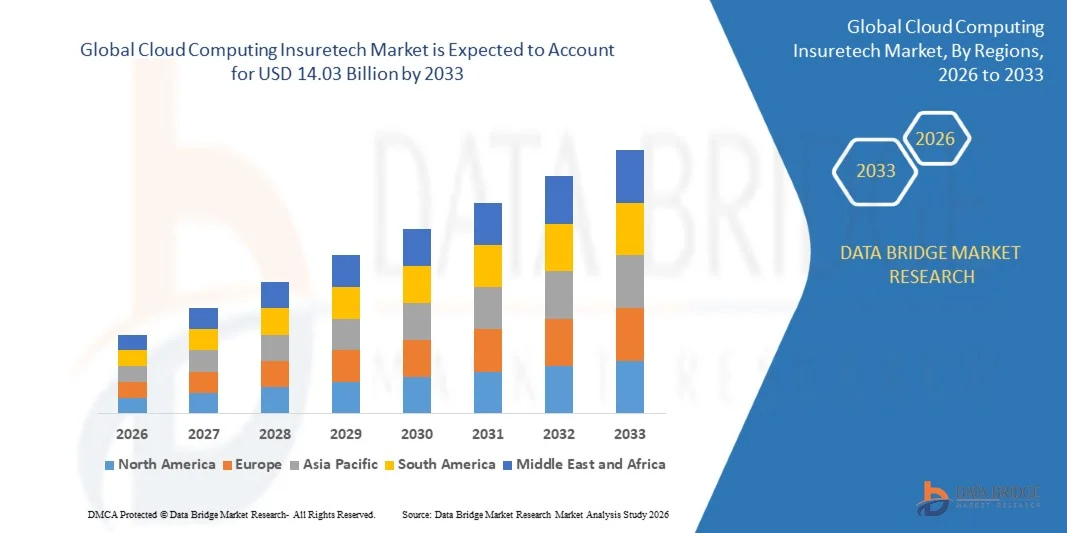

Cloud Computing Insuretech Market Graph: Growth, Share, Value, Size, and Insights By 2033

"Latest Insights on Executive Summary Cloud Computing Insuretech Market Share and Size

- The global cloud computing insuretech market size was valued at USD 6.31 billion in 2025 and is expected to reach USD 14.03 billion by 2033, at a CAGR of 10.50% during the forecast period

This Cloud Computing Insuretech Market research report is an absolute overview of the market that spans various aspects such as product definition, customary vendor landscape, and market segmentation based on various parameters such as type of product, its components, type of management, and geography. The report has wide-ranging and comprehensive market insights, which are based on business intelligence. The Cloud Computing Insuretech report is generated based on the market type, size of the organization, availability on-premises, the end-users’ organization type, and the availability in areas such as North America, South America, Europe, Asia-Pacific,, and the Middle East & Africa.

This market report examines market drivers, market restraints, challenges, opportunities and key developments in the Cloud Computing Insuretech Market What is more, this market research report also comprises of details about market analysis, market definition, market segmentation, key development areas, competitive analysis and research methodology. The Cloud Computing Insuretech report has estimations of CAGR values which are very important for businesses in deciding upon the investment value over the time period. To gain actionable market insights to build sustainable and money-spinning business strategies with an ease, Cloud Computing Insuretech business report is a great option.

Dive into the future of the Cloud Computing Insuretech Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/global-cloud-computing-insuretech-market

Cloud Computing Insuretech Business Outlook

Segments

- By Component: The cloud computing insuretech market can be segmented by component into services and solutions. The services segment includes professional services and managed services. Professional services are further categorized into consulting services, integration and deployment services, and support and maintenance services. The solutions segment comprises data storage, cloud-based analytics, customer management systems, and others.

- By Organization Size: Based on organization size, the market is divided into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are expected to witness significant growth in the adoption of cloud computing insuretech solutions due to their cost-effectiveness and scalability.

- By Application: The market can also be categorized by application into claims management, fraud detection, policy administration, billing & invoicing, and others. Claims management is anticipated to hold a substantial market share as insurers aim to streamline their claims processing operations with the help of cloud technologies.

- By End-User: In terms of end-users, the market can be segmented into insurance companies, insurance brokers, and agents. Insurance companies are the major adopters of cloud computing insuretech solutions to enhance their operational efficiency and provide personalized services to customers.

Market Players

- IBM Corporation: IBM offers a range of cloud computing solutions for the insurance sector, including AI-based analytics tools and cloud storage services. The company focuses on enhancing data security and providing real-time insights to insurers.

- Microsoft Corporation: Microsoft provides cloud-based platforms such as Azure for insuretech companies to leverage machine learning algorithms and enhance their customer engagement strategies. The company emphasizes the scalability and flexibility of its cloud solutions.

- Amazon Web Services, Inc.: Amazon Web Services (AWS) offers a comprehensive suite of cloud services for insuretech organizations, including data management tools and IoT integration capabilities. AWS positions itself as a reliable and cost-effective cloud provider for insurers.

- Google LLC: Google Cloud provides innovative solutions for the insurance industry, such as predictive modeling tools and automated claims processing systems. The company highlights the use of advanced technologies like machine learning and natural language processing in its cloud offerings.

- Salesforce.com, Inc.: Salesforce offers cloud-based customer relationship management (CRM) solutions tailored for the insurance sector. The company's CRM platform enables insurers to create personalized customer experiences and improve agent productivity.

The global cloud computing insuretech market is witnessing substantial growth, driven by the increasing adoption of digital technologies in the insurance industry. Insurers are embracing cloud computing solutions to streamline their operations, enhance customer engagement, and improve risk management practices. The market players mentioned above are at the forefront of providing innovative cloud solutions to cater to the evolving needs of the insuretech sector.

The cloud computing insuretech market is poised for continuous growth as insurance companies increasingly recognize the benefits of leveraging cloud technologies to optimize their operations. One emerging trend in the market is the integration of artificial intelligence (AI) and machine learning (ML) algorithms to enhance data analysis and customer engagement. Insurers are turning to cloud-based solutions offered by key market players such as IBM, Microsoft, Amazon Web Services, Google, and Salesforce to drive innovation and stay competitive in the digital age. These companies are continuously investing in research and development to deliver cutting-edge solutions tailored to the specific needs of the insurance sector.

Moreover, the demand for cloud computing insuretech solutions is being fueled by the need for enhanced data security and compliance with regulatory requirements. With the increasing volume of sensitive customer data being collected by insurers, the adoption of secure cloud infrastructure has become imperative to safeguard against cyber threats and data breaches. Market players are investing in robust security measures and encryption protocols to ensure the protection of confidential information and maintain the trust of policyholders.

Another key driver of market growth is the shift towards personalized customer experiences and data-driven decision-making in the insurance industry. Cloud computing solutions enable insurers to leverage big data analytics and predictive modeling tools to gain valuable insights into customer behavior, market trends, and risk assessment. By harnessing the power of cloud technology, insurance companies can enhance their underwriting processes, streamline claims management, and offer tailored products and services that meet the evolving needs of policyholders.

Furthermore, the scalability and flexibility of cloud-based platforms make them an attractive choice for insurers looking to modernize their IT infrastructure and adapt to changing market dynamics. Cloud solutions offer cost-effective alternatives to traditional on-premises systems, allowing insurance companies to scale their operations seamlessly and implement new functionalities with minimal disruption. As the demand for innovative digital solutions in the insurance sector continues to rise, market players are focusing on developing agile and user-friendly cloud platforms that empower insurers to drive operational efficiency and accelerate growth.

In conclusion, the global cloud computing insuretech market is poised for significant expansion as insurance companies harness the power of cloud technologies to drive digital transformation and deliver enhanced value to their stakeholders. The market players mentioned are playing a pivotal role in shaping the future of insuretech by offering innovative solutions that empower insurers to stay ahead of the curve in a rapidly evolving industry landscape. As the adoption of cloud computing continues to accelerate, we can expect to see further advancements in AI, data analytics, and customer engagement strategies that will redefine the way insurance business is conducted in the digital era.The cloud computing insuretech market is experiencing robust growth driven by the increasing digitalization of the insurance sector. Cloud solutions offer insurers the opportunity to streamline operations, enhance customer engagement, and improve risk management practices. One prominent trend in the market is the incorporation of artificial intelligence and machine learning algorithms into cloud-based platforms to bolster data analysis and customer interactions. Insurers are recognizing the value of leveraging advanced technologies to gain insights, mitigate risks, and deliver personalized services to policyholders.

Market players such as IBM, Microsoft, Amazon Web Services, Google, and Salesforce are playing a vital role in shaping the landscape of the cloud computing insuretech market. These companies offer a diverse range of cloud solutions tailored to the specific needs of the insurance industry. By investing in research and development, these market players are continuously innovating to deliver cutting-edge technologies that drive efficiency, competitiveness, and growth for insurers.

Moreover, the demand for cloud computing solutions in the insuretech sector is being fueled by the imperative of enhanced data security and regulatory compliance. With a growing volume of sensitive customer data at stake, insurers are turning to secure cloud infrastructure to fortify their defenses against cyber threats and uphold data privacy regulations. Market players are focusing on strengthening security measures and deploying encryption protocols to safeguard confidential information and uphold the trust of policyholders.

Another significant driver of market growth is the industry-wide shift towards personalized customer experiences and data-driven decision-making. Cloud computing solutions enable insurers to harness the power of big data analytics and predictive modeling, empowering them to make informed decisions, optimize operations, and design bespoke products and services that align with customer preferences and market trends. The scalability and flexibility of cloud platforms provide insurers with a cost-effective pathway to modernize their IT infrastructure, enabling seamless scalability and the integration of new functionalities to meet evolving market demands.

In conclusion, the cloud computing insuretech market is set for substantial expansion as insurance companies embrace digital transformation strategies. Market players' relentless pursuit of innovation and the integration of advanced technologies will continue to drive the evolution of the insuretech landscape. As the market matures, we can anticipate further advancements in AI, data analytics, and customer engagement solutions that will reshape the insurance industry's operational paradigms and foster sustained growth and competitiveness.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/global-cloud-computing-insuretech-market/companies

Cloud Computing Insuretech Market – Analyst-Ready Question Batches

- What is the current demand volume of the Cloud Computing Insuretech Market?

- How is the market for Cloud Computing Insuretech expected to evolve in the next decade?

- What segmentation criteria are applied in the Cloud Computing Insuretech Market study?

- Which players have the highest market share in the Cloud Computing Insuretech Market?

- What regions are assessed in the country-level analysisfor Cloud Computing Insuretech Market?

- Who are the top-performing companies in the Cloud Computing Insuretech Market?

Browse More Reports:

U.S. Cancer Treatment Market

Argentina Menopause Drugs Market

Chile Menopause Drugs Market

Asia-Pacific Left Ventricular Assist Device (LVAD) Market

Europe Left Ventricular Assist Device (LVAD) Market

North America Left Ventricular Assist Device (LVAD) Market

Asia-Pacific Sulfuric Acid Market

North America Sulfuric Acid Market

Asia-Pacific Acute Coronary Syndrome Market

Middle East and Africa Acute Coronary Syndrome Market

Europe Acute Coronary Syndrome Market

North America Acute Coronary Syndrome Market

U.S. Private Label Food and Beverages Market

Canada Private Label Food and Beverages Market

Middle East and Africa Retort Packaging Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- الاقتصاد والتجارة

- فن

- كورسات

- الحرف اليدوية

- الطعام والشراب

- الألعاب والترفيه

- الصحة

- تكنولوجيا

- أخرى

- دين

- رياضة